GlobeNewswire

2025-07-01The paroxysmal nocturnal hemoglobinuria market is witnessing robust growth, driven by increasing disease awareness, improved diagnostics, and the expanding adoption of targeted therapies. The approval and uptake of complement inhibitors like eculizumab and ravulizumab have significantly transformed the treatment landscape. Emerging pipeline candidates, such as Pozelimab (REGN3918) + Cemdisiran, Zaltenibart, Ruxoprubart, and others, are expected to further fuel market expansion.

New York, USA, July 01, 2025 (GLOBE NEWSWIRE) -- Paroxysmal Nocturnal Hemoglobinuria Market Set for Robust Growth During the Forecast Period (2025–2034) Owing to the Advancements in Complement Inhibitor Therapies | DelveInsight

The paroxysmal nocturnal hemoglobinuria market is witnessing robust growth, driven by increasing disease awareness, improved diagnostics, and the expanding adoption of targeted therapies. The approval and uptake of complement inhibitors like eculizumab and ravulizumab have significantly transformed the treatment landscape. Emerging pipeline candidates, such as Pozelimab (REGN3918) + Cemdisiran, Zaltenibart, Ruxoprubart, and others, are expected to further fuel market expansion.

DelveInsight's Paroxysmal Nocturnal Hemoglobinuria Market Insights report includes a comprehensive understanding of current treatment practices, emerging paroxysmal nocturnal hemoglobinuria drugs, market share of individual therapies, and current and forecasted paroxysmal nocturnal hemoglobinuria market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Paroxysmal Nocturnal Hemoglobinuria Market Report

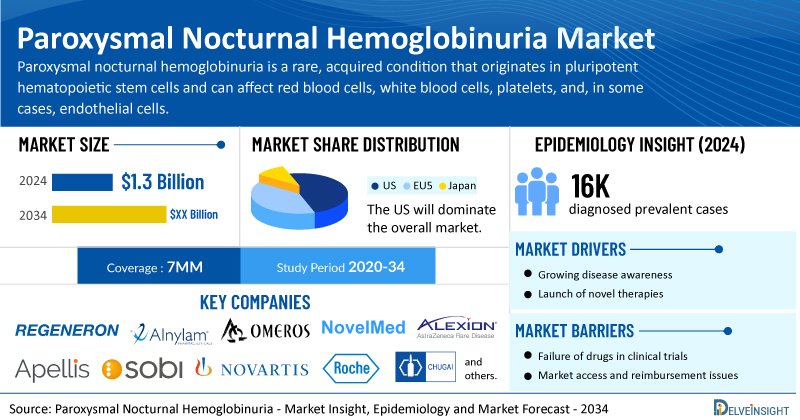

- According to DelveInsight's analysis, the total paroxysmal nocturnal hemoglobinuria market size was USD 1.3 billion in 2024 in the 7MM.

- The United States accounts for the largest market size of paroxysmal nocturnal hemoglobinuria, i.e., 85%, in comparison to EU4 (Germany, Italy, France, and Spain) and the UK, and Japan.

- In 2024, the PNH diagnosed prevalent cases were approximately 16,000 cases in the 7MM, which will increase by 2034.

- Prominent companies, including Regeneron Pharmaceuticals, Alnylam Pharmaceuticals, Omeros Corporation, NovelMed Therapeutics, and others, are actively working on innovative paroxysmal nocturnal hemoglobinuria drugs.

- Some of the key paroxysmal nocturnal hemoglobinuria therapies in the pipeline include Pozelimab (REGN3918) + Cemdisiran, Zaltenibart (OMS906), Ruxoprubart (NM8074), and others. These novel paroxysmal nocturnal hemoglobinuria therapies are anticipated to enter the paroxysmal nocturnal hemoglobinuria market in the forecast period and are expected to change the market.

- In May 2025, Otsuka and OPDC announced that the FDA had accepted the Biologics License Application for sibeprenlimab, an investigational antibody targeting APRIL, for the treatment of adults with IgA nephropathy (IgAN).

- In April 2025, Vera Therapeutics completed full enrollment in the pivotal ORIGIN Phase III trial evaluating atacicept in patients with IgAN.

Discover which paroxysmal nocturnal hemoglobinuria medications are expected to grab the market share @ Paroxysmal Nocturnal Hemoglobinuria Market Report

Paroxysmal Nocturnal Hemoglobinuria Overview

Paroxysmal nocturnal hemoglobinuria is a rare, acquired condition that originates in pluripotent hematopoietic stem cells and can affect red blood cells, white blood cells, platelets, and, in some cases, endothelial cells. The disorder results from a somatic mutation in the X-linked PIG-A gene, which is essential for the synthesis of glycosylphosphatidylinositol anchors, molecules that tether specific proteins to the cell surface.

This mutation causes a lack of GPI anchors, leading to reduced expression of key complement-regulating proteins like decay-accelerating factor (DAF/CD55) and membrane inhibitor of reactive lysis (MIRL/CD59) on hematopoietic stem cells and their progeny. The absence of these protective proteins renders red blood cells vulnerable to destruction by the complement system, triggering complement-mediated intravascular hemolysis. This process releases free hemoglobin into the bloodstream, which binds to and depletes nitric oxide.

Previously, PNH was diagnosed using tests like the Ham test or the sucrose lysis test, but these are now outdated. Today, flow cytometry (FCM) is the standard diagnostic method, identifying the characteristic absence of GPI-anchored proteins. This is done using monoclonal antibodies (e.g., anti-CD55, anti-CD59) or fluorescein-labeled proaerolysin (FLAER), which binds to the glycan portion of the GPI anchor. FLAER is particularly useful for detecting GPI deficiencies in nucleated cells, as it does not effectively stain red blood cells due to interference from glycophorin, a protein abundant on their surface that disrupts aerolysin binding.

Paroxysmal Nocturnal Hemoglobinuria Epidemiology Segmentation

The paroxysmal nocturnal hemoglobinuria epidemiology section provides insights into the historical and current paroxysmal nocturnal hemoglobinuria patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The paroxysmal nocturnal hemoglobinuria market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total PNH Diagnosed Prevalent Cases

- PNH Gender-specific Cases

- PNH Age Group-Specific Cases

- Total PNH Treated Cases

Download the report to understand which factors are driving paroxysmal nocturnal hemoglobinuria epidemiology trends @ Paroxysmal Nocturnal Hemoglobinuria Treatment Algorithm

Paroxysmal Nocturnal Hemoglobinuria Treatment Market

The conventional approach to treating PNH primarily relies on C5 inhibitors. Eculizumab (SOLIRIS) and ravulizumab (ULTOMIRIS) are FDA-approved monoclonal antibodies that target terminal complement activation by blocking C5, thereby preventing the generation of C5a and the membrane attack complex (C5b–9). Both therapies, delivered through intravenous infusion, bind to the same epitope on C5; however, ravulizumab has been engineered for a prolonged half-life. Developed by Alexion Pharmaceuticals, SOLIRIS was the first breakthrough in PNH therapy, later followed by ULTOMIRIS, marking significant progress in C5 inhibition.

While these treatments have been central to PNH care, the therapeutic landscape is evolving with the introduction of pegcetacoplan and the emergence of iptacopan from Novartis, offering promising new alternatives. Pegcetacoplan (EMPAVELI), the first approved C3 inhibitor, has received regulatory clearance from both the FDA and EMA and signifies a notable advancement by targeting an upstream component of the complement cascade. Additionally, FABHALTA (iptacopan), an oral Factor B inhibitor developed by Novartis, has recently been approved. It is being investigated for multiple complement-driven conditions, including IgA nephropathy, C3 glomerulopathy, immune complex membranoproliferative glomerulonephritis, and atypical hemolytic uremic syndrome (aHUS), further expanding its potential therapeutic impact.

Learn more about the paroxysmal nocturnal hemoglobinuria treatment options @ Paroxysmal Nocturnal Hemoglobinuria Treatment Guidelines

Paroxysmal Nocturnal Hemoglobinuria Emerging Drugs and Companies

The Expected launch of potential therapies may increase the market size in the coming years, assisted by an increase in the diagnosed prevalent population of PNH. Owing to the positive outcomes of several products during the developmental stage by key players such as Regeneron Pharmaceuticals (REGN3918), Omeros (Zaltenibart), NovelMed (Ruxoprubart), and others. The PNH market is expected to witness a significant positive shift in the forecast period of 2025-2034.

Pozelimab is an investigational, fully human monoclonal antibody developed to inhibit complement factor C5, thereby preventing hemolysis, the destruction of red blood cells, that leads to the clinical manifestations of paroxysmal nocturnal hemoglobinuria and other complement-mediated disorders. As an IgG4 antibody, it binds with high affinity to both wild-type and variant forms of C5, effectively blocking their activity. Pozelimab was created using Regeneron's VelocImmune platform, which employs genetically humanized mice to generate optimized fully human antibodies. The therapy is currently in Phase III clinical trials.

Zaltenibart (OMS906) is a leading monoclonal antibody that targets MASP-3, a key enzyme in activating the alternative complement pathway. It is in Phase II development for PNH and complement 3 glomerulopathy. In a Phase I trial involving healthy volunteers, the therapy was well tolerated with no significant safety concerns. OMS906 has received Orphan Drug Designation (ODD) from the FDA for PNH, and two open-label, multicenter trials are currently underway in adults with PNH.

Ruxoprubart is a next-generation humanized monoclonal antibody that specifically targets protein Bb of the alternative complement pathway, distinguishing it from agents like Iptacopan (FABHALTA) due to its lack of binding to Factor B. As a strong inhibitor of the Alternative Pathway, Ruxoprubart showed favorable safety and tolerability in a completed Phase I trial with healthy volunteers. It is now progressing to a Phase II multi-dose study in treatment-naïve PNH patients, representing the first anti-Bb biologic to be tested in this population. The FDA has authorized Phase II trials for multiple conditions, including C3G, atypical hemolytic uremic syndrome (aHUS), and ANCA-associated vasculitis (AAV)—all scheduled to occur in the U.S. Notably, in 2024, Ruxoprubart received FDA Orphan Drug Designation for the treatment of PNH.

The anticipated launch of these emerging paroxysmal nocturnal hemoglobinuria therapies are poised to transform the paroxysmal nocturnal hemoglobinuria market landscape in the coming years. As these cutting-edge paroxysmal nocturnal hemoglobinuria therapies continue to mature and gain regulatory approval, they are expected to reshape the paroxysmal nocturnal hemoglobinuria market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for paroxysmal nocturnal hemoglobinuria, visit @ Paroxysmal Nocturnal Hemoglobinuria Management

Paroxysmal Nocturnal Hemoglobinuria Market Dynamics

The paroxysmal nocturnal hemoglobinuria market dynamics are anticipated to change in the coming years. An improved understanding of the role of uncontrolled complement activation in PNH has significantly advanced its diagnosis and management over the years, driven by a strong industry presence from major pharmaceutical companies such as Alexion (AstraZeneca), Amgen, and Takeda, fostering a highly competitive and innovative treatment landscape.

The introduction of the C5-targeting monoclonal antibody eculizumab has transformed the natural history of PNH in the past decade, creating opportunities for the development of new biomarkers to assess thrombotic risk. Meanwhile, the emergence of biosimilars like Bkemv and Epysqli, along with evolving pricing strategies and improved reimbursement frameworks, is enhancing affordability and accessibility, particularly in developing regions.

Furthermore, many potential therapies are being investigated for the treatment of paroxysmal nocturnal hemoglobinuria, and it is safe to predict that the treatment space will significantly impact the paroxysmal nocturnal hemoglobinuria market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the paroxysmal nocturnal hemoglobinuria market in the 7MM.

However, several factors may impede the growth of the paroxysmal nocturnal hemoglobinuria market. Despite treatment with a C5 inhibitor, patients with conditions like PNH may still suffer from ongoing hemolysis, chronic anemia, transfusion dependence, fatigue, and diminished quality of life, compounded by limited physician awareness of the disease's varied and overlapping symptoms, the lack of extensive multicenter research on diagnostic efficiency, and growing market challenges posed by biosimilars such as Bkemv and Epysqli, which, while enhancing affordability, are intensifying pricing pressures and prompting strategic reassessments by pharmaceutical companies.

Moreover, paroxysmal nocturnal hemoglobinuria treatment poses a significant economic burden and disrupts patients' overall well-being and QOL. Furthermore, the paroxysmal nocturnal hemoglobinuria market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the paroxysmal nocturnal hemoglobinuria market growth.

| Paroxysmal Nocturnal Hemoglobinuria Report Metrics | Details |

| Study Period | 2020–2034 |

| Paroxysmal Nocturnal Hemoglobinuria Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Paroxysmal Nocturnal Hemoglobinuria Market Size | USD 1.3 Billion |

| Key Paroxysmal Nocturnal Hemoglobinuria Companies | Regeneron Pharmaceuticals, Alnylam Pharmaceuticals, Omeros Corporation, NovelMed Therapeutics, AstraZeneca (Alexion Pharmaceuticals), Apellis Pharmaceuticals, Swedish Orphan Biovitrum, Novartis, Hoffmann-La Roche, Chugai Pharmaceutical, and others |

| Key Paroxysmal Nocturnal Hemoglobinuria Therapies | Pozelimab (REGN3918) + Cemdisiran, Zaltenibart (OMS906), Ruxoprubart (NM8074), ULTOMIRIS (ravulizumab), EMPAVELI/ ASPAVELI (pegcetacoplan), VOYDEYA (danicopan), FABHALTA (iptacopan), PIASKY (Crovalimab), and others |

Scope of the Paroxysmal Nocturnal Hemoglobinuria Market Report

- Paroxysmal Nocturnal Hemoglobinuria Therapeutic Assessment: Paroxysmal Nocturnal Hemoglobinuria current marketed and emerging therapies

- Paroxysmal Nocturnal Hemoglobinuria Market Dynamics: Conjoint Analysis of Emerging Paroxysmal Nocturnal Hemoglobinuria Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL's views, Analyst's views, Paroxysmal Nocturnal Hemoglobinuria Market Access and Reimbursement

Discover more about paroxysmal nocturnal hemoglobinuria drugs in development @ Paroxysmal Nocturnal Hemoglobinuria Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | PNH Market Overview at a Glance |

| 3.1 | Market Share (%) Distribution of PNH by Country in 2024 in the 7MM |

| 3.2 | Market Share (%) Distribution of PNH by Country in 2034 in the 7MM |

| 4 | Epidemiology and Market Forecast Methodology |

| 5 | Executive Summary of PNH |

| 6 | Key Events |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Signs and Symptoms |

| 7.3 | Causes |

| 7.4 | Clinical Forms of PNH |

| 7.5 | Clinical Manifestations |

| 7.6 | Prognosis of PNH |

| 7.7 | Pathophysiology of PNH |

| 7.8 | Diagnosis |

| 7.8.1 | Summary and Diagnostic Criteria |

| 7.8.2 | Differential Diagnosis |

| 8 | Treatment and Management |

| 8.1 | The Current Standard of Care |

| 8.2 | Supportive and Immunosuppressive Treatments |

| 8.3 | Treatment Guidelines |

| 8.3.1 | Reference Guide for the Management of Paroxysmal Nocturnal Hemoglobinuria (Reiwa 4th Edition) |

| 8.4 | Treatment Algorithm |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationale |

| 9.3 | Total Diagnosed Prevalent Cases of PNH in 7MM |

| 9.4 | Total Treated Cases of PNH in 7MM |

| 9.5 | The United States |

| 9.5.1 | Total Diagnosed Prevalent Cases of PNH in the United States |

| 9.5.2 | Gender-specific Cases of PNH in the United States |

| 9.5.3 | Age group-specific Cases of PNH in the United States |

| 9.5.4 | Treated Cases of PNH in the United States |

| 9.6 | EU4 and the UK |

| 9.6.1 | Total Diagnosed Prevalent Cases of PNH in EU4 and the UK |

| 9.6.2 | Gender-specific Cases of PNH in EU4 and the UK |

| 9.6.3 | Age-specific Cases of PNH in EU4 and the UK |

| 9.6.4 | Total Treated Cases of PNH in EU4 and the UK |

| 9.7 | Japan |

| 9.7.1 | Total Diagnosed Prevalent Cases of PNH Japan |

| 9.7.2 | Gender-specific Cases of PNH in Japan |

| 9.7.3 | Age group-specific Cases of PNH in Japan |

| 9.7.4 | Treated Cases of PNH in Japan |

| 10 | Patient Journey |

| 11 | Marketed Therapies |

| 11.1 | Key cross |

| 11.2 | ULTOMIRIS (ravulizumab): AstraZeneca (Alexion Pharmaceuticals) |

| 11.2.1 | Product Description |

| 11.2.2 | Regulatory Milestone |

| 11.2.3 | Other Developmental Activities |

| 11.2.4 | Clinical Developmental Activities |

| 11.2.5 | Safety and efficacy |

| 11.3 | EMPAVELI/ ASPAVELI (pegcetacoplan): Apellis Pharmaceuticals/ Swedish Orphan Biovitrum |

| 11.3.1 | Product Description |

| 11.3.2 | Regulatory Milestone |

| 11.3.3 | Other Developmental Activities |

| 11.3.4 | Clinical Developmental Activities |

| 11.3.5 | Safety and Efficacy |

| 11.4 | VOYDEYA (danicopan): AstraZeneca (Alexion Pharmaceuticals) |

| 11.4.1 | Product Description |

| 11.4.2 | Regulatory Milestone |

| 11.4.3 | Other Developmental Activity |

| 11.4.4 | Clinical Development |

| 11.4.5 | Safety and efficacy |

| 11.5 | FABHALTA (iptacopan): Novartis |

| 11.5.1 | Product Description |

| 11.5.2 | Regulatory Milestone |

| 11.5.3 | Other Developmental Activities |

| 11.5.4 | Clinical Development |

| 11.5.5 | Safety and Efficacy |

| 11.6 | PIASKY (Crovalimab): Hoffmann-La Roche/Chugai Pharmaceutical |

| 11.6.1 | Product Description |

| 11.6.2 | Regulatory Milestone |

| 11.6.3 | Other Developmental Activities |

| 11.6.4 | Clinical Development |

| 11.6.5 | Safety and Efficacy |

| 12 | Emerging Therapies |

| 12.1 | Key Cross Competition |

| 12.2 | Pozelimab (REGN3918) + Cemdisiran: Regeneron Pharmaceuticals/Alnylam Pharmaceuticals |

| 12.2.1 | Product Description |

| 12.2.2 | Other Developmental Activities |

| 12.2.3 | Clinical Development |

| 12.2.4 | Safety and Efficacy |

| 12.2.5 | Analyst View |

| 12.3 | Zaltenibart (OMS906): Omeros Corporation |

| 12.3.1 | Product Description |

| 12.3.2 | Other Developmental Activities |

| 12.3.3 | Clinical Development |

| 12.3.4 | Safety and Efficacy |

| 12.3.5 | Analyst View |

| 12.4 | Ruxoprubart (NM8074): NovelMed Therapeutics |

| 12.4.1 | Product Description |

| 12.4.2 | Other Developmental Activities |

| 12.4.3 | Clinical Development |

| 12.4.4 | Safety and Efficacy |

| 12.4.5 | Analyst View |

| 13 | PNH: 7 Major Market Analysis |

| 13.1 | Key Findings |

| 13.2 | Conjoint Analysis |

| 13.3 | Market Outlook |

| 13.4 | Key Market Forecast Assumptions |

| 13.5 | Total Market Size of PNH in the 7MM |

| 13.6 | Total Market Size of PNH by Therapies in the 7MM |

| 13.7 | United States Market Size |

| 13.7.1 | Total Market Size of PNH in the US (2020–2034) |

| 13.7.2 | Market Size of PNH by Therapies in the United States (2020-2034) |

| 13.8 | EU4 and the UK Market Size |

| 13.8.1 | Total Market Size of PNH in EU4 and the UK (2020-2034) |

| 13.8.2 | Market Size of PNH by Therapies in EU4 and the UK (2020-2034) |

| 13.9 | Japan Market Size |

| 13.9.1 | Total Market Size of PNH in Japan (2020-2034) |

| 13.9.2 | Market Size of PNH by Therapies (2020–2034) |

| 14 | KOL Views |

| 15 | SWOT Analysis |

| 16 | Unmet Needs |

| 17 | Reimbursement Scenario in PNH |

| 17.1 | Patient Access Programs |

| 17.1.1 | The United States |

| 17.2 | HTA Decisions |

| 17.2.1 | Germany |

| 17.2.2 | France |

| 17.2.3 | Italy |

| 17.2.4 | Spain |

| 17.2.5 | The United Kingdom |

| 17.3 | Japan |

| 18 | Appendix |

| 18.1 | Bibliography |

| 18.2 | Report Methodology |

| 19 | DelveInsight Capabilities |

| 20 | Disclaimer |

Related Reports

Complement Inhibitors Market

Complement Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report deliver an in-depth understanding of the market trends, market drivers, market barriers, and key complement inhibitors companies including AstraZeneca, Annexon, Inc., Dianthus Therapeutics, Alsonex Pharmaceuticals, Mallinckrodt, CANbridge Pharmaceuticals, Beijing Defengrei Biotechnology, NovelMed Therapeutics, DynamiCure Biotechnology, CSL Behring, Kriya Therapeutics, Argenx, Arrowhead Pharmaceuticals, Amyndas Pharmaceuticals, Q32 Bio, Kira Pharmaceuticals, ReAlta Life Sciences, ISU Abxis, among others.

Paroxysmal Nocturnal Hemoglobinuria Pipeline

Paroxysmal Nocturnal Hemoglobinuria Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key PNH companies, including Hoffmann-La Roche, Apellis Pharmaceuticals, Regeneron Pharmaceuticals, Biocad, AKARI Therapeutics, Alexion Pharmaceuticals, Novartis Pharmaceuticals, Amgen, BioCryst Pharmaceuticals, MorphoSys, Ra Pharmaceuticals, Alnylam Pharmaceuticals, Arrowhead Pharmaceuticals, Wuhan Createrna Science and Technology, CANbridge, Attune Pharmaceuticals, RallyBio, among others.

Complement 3 Glomerulopathy Market

Complement 3 Glomerulopathy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key C3G companies including Novartis Pharmaceuticals, Apellis Pharmaceuticals, among others.

Atypical Hemolytic Uremic Syndrome Market

Atypical Hemolytic Uremic Syndrome Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key aHUS companies including Novartis Pharmaceuticals, Hoffmann-La Roche, Chugai Pharmaceutical, among others.

IgA Nephropathy Market

IgA Nephropathy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key IgAN companies including Novartis, F. Hoffmann-La Roche, Ionis Pharmaceuticals, AstraZeneca (Alexion Pharmaceuticals), Vertex Pharmaceuticals, Otsuka Pharmaceutical, Biogen, Arrowhead Pharmaceuticals, NovelMed, Q32 Bio, Walden Biosciences, Takeda Pharmaceutical, Vera Therapeutics, among others.

DelveInsight's Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Pipeline Assessment

Healthcare Licensing Services

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

CONTACT: Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

www.delveinsight.com